How Much Money to Open a Wells Fargo Account 2025

Opening a bank account is an essential financial step for many people, whether it’s for saving money, managing expenses, or simply having a safe place for your funds. Wells Fargo is one of the largest and most well-known banks in the United States, offering a range of banking products, including checking and savings accounts. If you’re considering opening a Wells Fargo account, you might wonder how much money you’ll need to get started. In this article, we’ll break down the requirements, including minimum deposits, fees, and other important details to help you understand what to expect when opening an account with Wells Fargo.

Types of Wells Fargo Accounts

Wells Fargo offers various types of accounts, each with different features, benefits, and deposit requirements. The two most common types of accounts are checking accounts and savings accounts. Both types of accounts may have different minimum deposit requirements, fees, and balance conditions.

Checking Accounts

Wells Fargo offers several types of checking accounts, including:

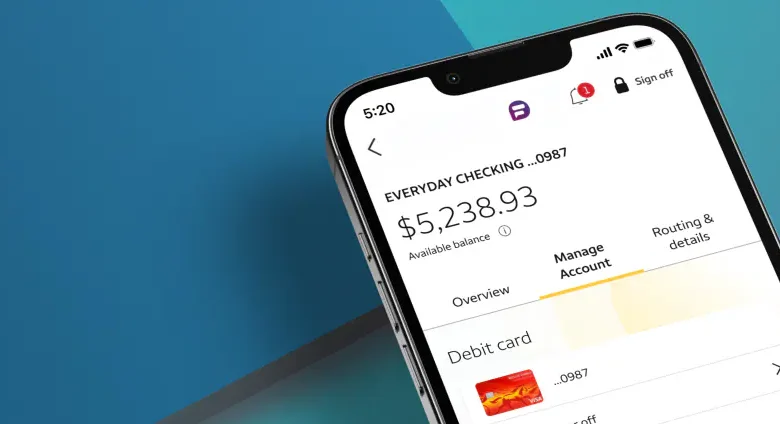

- Wells Fargo Everyday Checking: This is a basic checking account designed for daily transactions, such as paying bills and making purchases.

- Wells Fargo Prime Checking: This account offers premium benefits, including higher interest rates and personalized services.

- Wells Fargo Clear Access Banking: Aimed at people who may want a simple, no-checkbook account with lower fees and fewer requirements.

Each of these accounts has different opening balance requirements and maintenance fees, which we will explore below.

Savings Accounts

Wells Fargo also provides several savings account options:

- Way2Save Savings Account: This is a basic savings account designed for people who want to save a little bit of money with minimal fees.

- Wells Fargo Platinum Savings: This account offers a higher interest rate but requires a larger minimum deposit.

- Wells Fargo High Yield Savings: This account offers a higher interest rate but may require a larger minimum deposit as well.

The requirements for these accounts also differ, so it’s important to choose one that aligns with your financial goals and capabilities.

Minimum Deposit Requirements for Wells Fargo Accounts

When opening a Wells Fargo account, there is typically a minimum deposit required to activate the account. The amount can vary based on the type of account you’re opening.

Minimum Deposit for Checking Accounts

- Wells Fargo Everyday Checking: To open this account, you need a minimum deposit of $25. This is a relatively low amount, making it a great option for those who don’t want to commit a large sum of money upfront.

- Wells Fargo Prime Checking: The minimum deposit required to open this account is $1,000. This is a higher requirement, but it comes with additional benefits, such as a higher interest rate and premium services.

- Wells Fargo Clear Access Banking: This is designed as a low-cost option, and the minimum deposit to open the account is $25.

Minimum Deposit for Savings Accounts

- Way2Save Savings Account: The minimum deposit to open this account is $25. It’s an affordable way to start saving money without needing a large sum upfront.

- Wells Fargo Platinum Savings: To open this account, you’ll need a minimum deposit of $300. This account offers a higher interest rate, which may be appealing if you want to save larger sums of money.

- Wells Fargo High Yield Savings: The minimum deposit to open this account is $25, making it another affordable savings option.

Fees Associated with Wells Fargo Accounts

In addition to the minimum deposit, you should also be aware of any fees associated with your Wells Fargo account. These fees can vary based on the account type and how you use the account. Below are the main fees to consider:

Monthly Maintenance Fees

Many Wells Fargo accounts charge a monthly maintenance fee, but these fees can often be waived by meeting certain requirements, such as maintaining a minimum daily balance, making a certain number of transactions, or setting up direct deposit.

- Wells Fargo Everyday Checking: The monthly maintenance fee is $10. However, it can be waived if you maintain a minimum daily balance of $1,500 or more, or if you have a direct deposit of at least $500 per month.

- Wells Fargo Prime Checking: This account has a monthly maintenance fee of $25, but it can be waived if you maintain a balance of $10,000 or more in linked accounts, or if you meet certain other conditions.

- Wells Fargo Clear Access Banking: The monthly fee is $5, but it can be waived if you are a student under 24 years old or if you set up a direct deposit of at least $500 each month.

- Way2Save Savings Account: This account has a $5 monthly fee, which can be waived if you maintain a $300 balance or set up a recurring transfer of at least $25 per month.

- Wells Fargo Platinum Savings: The monthly fee is $12, which can be waived if you maintain a balance of $3,500 or more.

Other Fees

In addition to the monthly maintenance fees, there may be other fees, such as:

- ATM fees: Wells Fargo offers fee-free ATM access at its own ATMs, but if you use ATMs outside of Wells Fargo’s network, you may incur a fee.

- Overdraft fees: If you spend more than what is available in your account, you may face overdraft fees. These can range from $35 per item.

- Wire transfer fees: There are fees for sending or receiving wire transfers, especially for international transactions.

It’s important to read the fee schedule for the specific account you are interested in so you can avoid unnecessary charges.

How to Avoid Fees

To minimize fees, there are several ways you can manage your account:

- Maintain the required minimum balance: For most accounts, maintaining a minimum balance is the easiest way to avoid monthly fees.

- Set up direct deposit: Many accounts waive monthly fees if you have a direct deposit set up, so consider having your paycheck or government benefits deposited directly into your Wells Fargo account.

- Link accounts: Some accounts allow you to link multiple Wells Fargo accounts to meet the minimum balance requirements for fee waivers.

Conclusion

Opening a Wells Fargo account is an easy and convenient way to manage your finances. The amount of money required to open an account varies depending on the type of account you choose. Checking accounts typically require a deposit of $25 to $1,000, while savings accounts range from $25 to $300. While Wells Fargo does charge monthly maintenance fees, you can often avoid these fees by maintaining a minimum balance, setting up direct deposit, or linking accounts.

Before opening an account, make sure to review the fee structures and minimum deposit requirements to find the account that best fits your financial needs.